About Us

Why Pecuniary

Pecuniary means related to money, and the word Pecuniary itself says how serious a company is when recommending financial portfolios to clients. The portfolio we design is totally hedged or, in other words, bulletproof by investing in different asset classes. The firm focuses on investing in companies with predictable and consistent earnings and can typically generate above-average earnings growth over extended periods. We work tirelessly to bring our clients innovative, reliable, cost-effective, and time-saving solutions. We operate with honesty & fairness in all aspects of our segments.

Mission

- We aim to be the number one financial advisor by complying with the needs of many.

- Providing excellent investment opportunities with correct advice that helps customers achieve the best.

- Creating a trustworthy and symbiotic work culture for our team and a belief that their success is proportional to ours.

- We aim to build and maintain relationship with investors for a long time and help them gain quality returns.

Vision

- Ensuring to work with the highest professional standards with our experience and insights

- Adhering to principles, values, and ethics at all times

- Work dedicatedly and ensure to gain the trust of our investors by providing them with the correct advice.

- Keeping transparent policy and building mutual trust between company and customers

Our Expertise

Pecuniary

At Pecuniary, we provide solutions to common financial symptoms.

Holistic

Process

We follow a holistic process that addresses a client’s entire financial picture, their needs for today and their goals for tomorrow.

Implement

Strategy

Once we understand their needs and financial situation, we put forward our recommendations and implement a strategy.

Financially

Organized

We believe in understanding a client’s present and future needs and helping them stay financially organized.

Meet the team behind

our great projects

Our Core Values

Integrity

We ensure each product or service you invest in provides you with all the required information, thus ensuring there are no surprises and disappointments.

Diversity

We diversify clients' investments into different suitable channels and not in just one, based on their risk matrix to minimize the risk.

Transparency

We believe in transparency conduct while allocating and refining service costs and others. We share correct and real-time information without misleading them or giving them fake expectations only to get business.

Confidentiality

It means ensuring that information is accessible only to those authorized to have access.

Professionalism

It requires behaving with dignity and courtesy to clients. We believe in working on retaining this quality throughout, thus providing a complete professional and diligent service.

Focus

We follow an unbiased client focus throughout the association. Our focus lies in growing as a client-centric company.

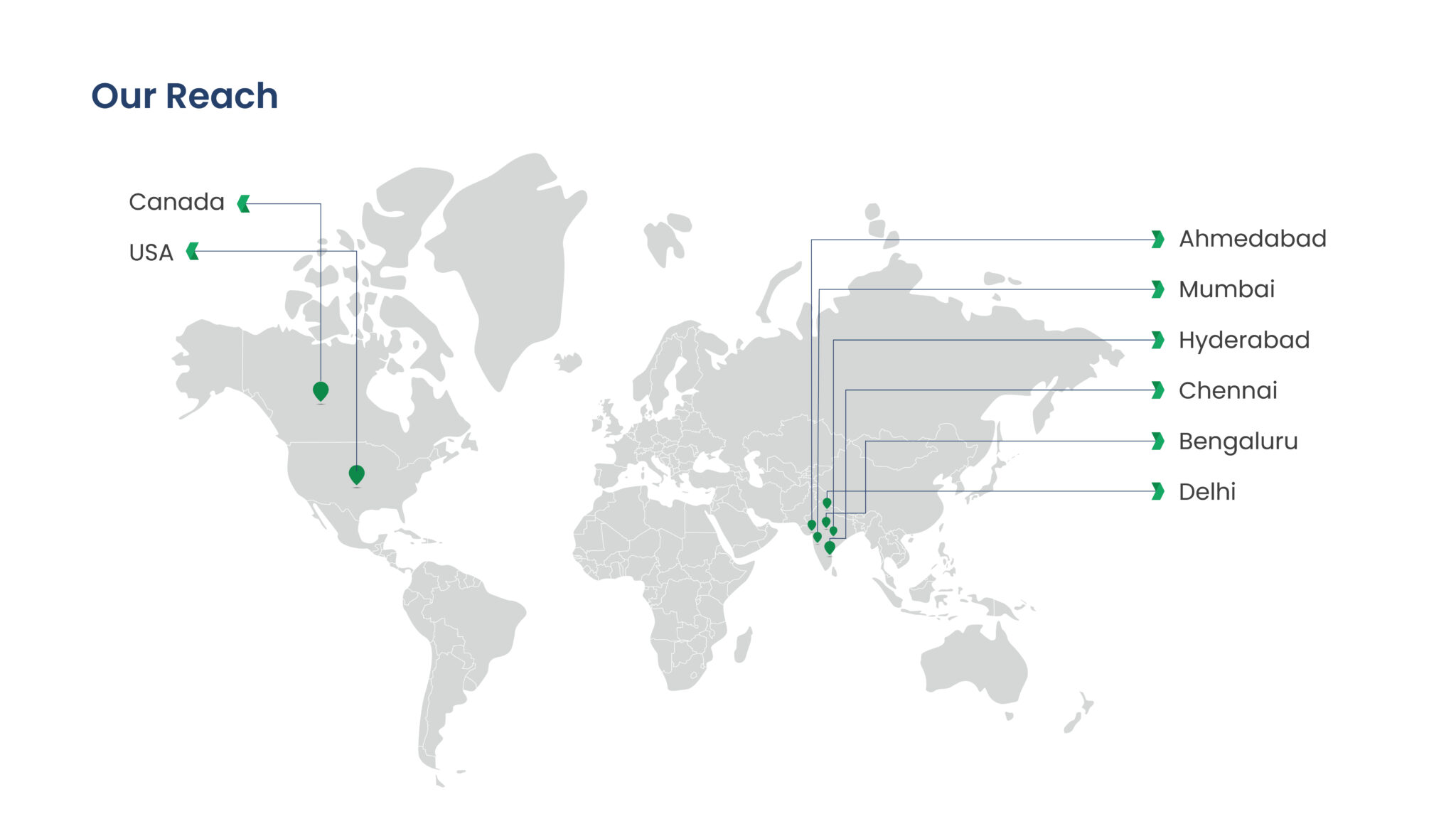

Our Presence

We are an independent investment and advisory company serving everyone globally.